The challenges facing businesses today don’t have to be daunting.

Startups, fast-growing businesses and small companies with complex operations are turning to part-time – also called fractional or portfolio – CFOs to provide stability, confidence and strategic guidance to founders, CEOs, board members and investors.

In this guide, we’ll cover:

- The modern CFO – no longer just about finance?

- What’s causing this change?

- The rise of the fractional CFO

- What’s driving demand for fractional finance leaders?

- Who benefits from hiring a fractional CFO?

- Hiring a fractional CFO (a 4-step roadmap)

- Onboarding challenges to prepare for

The modern CFO – no longer just about finance?

In recent years, the role of the modern CFO has changed significantly.

Finance has always had a central controlling role in business, in achieving targets, creating stakeholder value and reporting to investors at large. That’s now expanded beyond traditional accounting/finance. As CFO, now I am responsible for many things beyond the traditional finance function, says Rob Nicholls, a fractional CFO and strategic advisor.

Yes, CFOs are still responsible for all traditional areas of finance including cash flow, financial planning and strategy. But they have a broader mandate too:

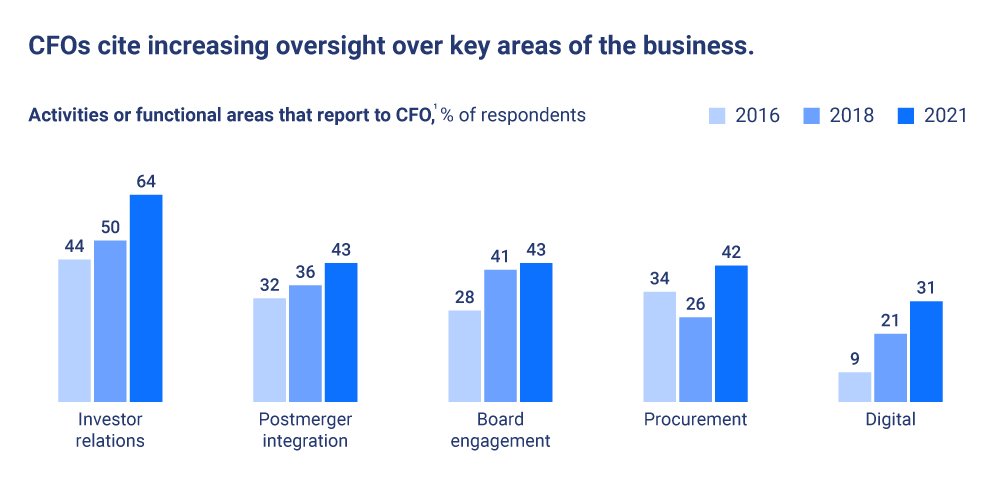

- More functions now report to CFOs. Six today compared to four in 2016.

- CFOs have become responsible for other key areas of the business, including investor relations, post-merger integration and procurement.

- The role has become more cross-functional, playing a more active role in driving transformation and influencing change in the company.

- CFOs are expected to drive long-term performance over short-term performance.

- More CFOs are at the forefront of digitisation, becoming involved in areas such as automation, analytics, AI, and data visualisation.

This chart from McKinsey demonstrates the increasing responsibilities of a modern CFO

The CFO’s role today is to “join the dots up in an organisation”, as Jim Shirley, CFO and founder of FundingHero, explains:

“They need to be the person that can tie everything together. The numbers paint a thousand words and the CFO has a unique position to be able to take the figures and understand all of the contributing factors that make them up and translate them back into the business. This is a critical skill that isn’t always fully understood.

What’s causing this change?

With more capital investment being poured into startups – as we’ll explore in more detail below – we’re seeing the finance function come under scrutiny to a far greater extent than ever before, as Jennifer Brook Botfield, Global Head of Interim and Consulting at Zeren, explains:

“In the last year or so, where we have seen wildly ambitious valuations across investment-backed businesses, a more sustainable return on investment at pace is required, creating a spotlight on the role of the CFO.

Finance no longer exists simply as a back office function but instead must thread through every department, creating stronger alignment to revenue and growth goals that are needed to secure future funding or exit strategies.”

Finance has always had this level of accountability, but not to this degree. Higher levels of investment increase the pressure to make returns on those investments faster. Meaning a big four-qualified “CFO-as-auditor” is no longer enough.

Add to this the increasing importance of digital technologies relevant to the finance function (data, analytics, automation, etc.). CFOs are gatekeepers of these digital functions, which allows them to make forecasts and support top-level decision-making.

It means the CFO is at the centre of all this. Their ability to translate the impacts of decisions into financial outcomes is fundamental to an effective business in the modern day that needs to respond rapidly to changing economic conditions.

The rise of the fractional CFO

The evolution of the chief finance function has coincided with another development in the role of a chief finance officer: the “fractional” CFO. So what does it mean?

A fractional CFO – also known as an outsourced or portfolio CFO – is someone who provides strategic advisory support to startups and small businesses on a part-time basis. It means that a startup can access the knowledge, experience and strategic guidance by hiring a fractional CFO without hiring one full-time.

The role of a fractional CFO differs slightly from an interim CFO. Interims are typically brought on for six months up to a year to cover temporary absences, such as maternity leave. Whereas hiring a fractional CFO is usually a longer-term appointment, brought on to provide strategic support for a specific project, such as preparing to exit or cash runway management.

For Jim Shirley, CFOs give founders and CEOs the “visibility to make decisions”, which is one of the most important and valuable needs for early-stage businesses that lack strategic oversight and guidance:

“They generally suffer from lack of quality information to make real strategic decisions that can make or break their business, so they are flying blind.

They are financially immature, so they need some assistance to establish some basics around meaningful metrics to track, regular reporting that drives the right strategic actions, and then a suitable funding & working capital strategy to make sure they don’t starve themselves of cash to grow at the right time.”

Growing demand for “fractional” roles are not limited to the finance function either. It’s a growing trend in other specialist areas including marketing (CMO), product (CPO), technology (CIO and CTO), HR, (CHRO), and revenue management (CRO).

What’s driving the demand for fractional CFOs?

One thing is clear: the demand for fractional CFOs is on the rise.

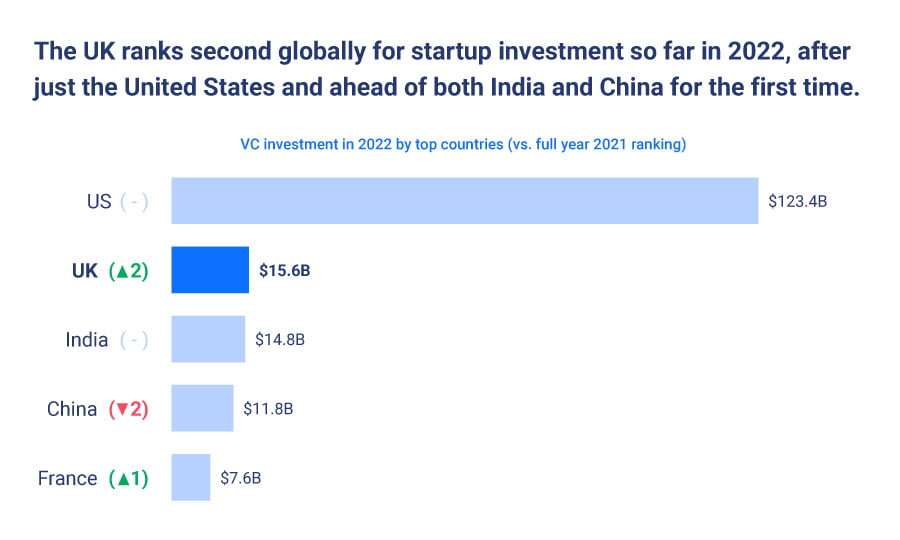

UK tech startups and scaleups are also seeing record amounts of investment. In Q1 2022, $11.3B was raised, more than any other country in the world apart from the US. This is following a record year in 2021, especially in London, where startup investment reached an all-time high of $25.5B, a 2.3x year-on-year growth rate.

This graph from Dealroom shows how the UK ranks for global startup investment

A big influx of capital makes financial matters more complicated and creates a gap that needs to be filled by someone who can provide high-level guidance. Whether it’s creating long-term financial forecasts, planning to expand to new markets, giving investors and board members confidence, helping evaluate potential mergers, or preparing for a new investment round, an experienced CFO can plug those gaps.

“One of the best things we did at Luna in the really early days was to get a fractional CFO. It took so much pressure off me because building models isn’t my strong point. I had to admit where my weaknesses are, but I made sure to plug that gap immediately”, says James Roycroft-David, CEO of Luna.

But it’s not just an influx of capital into startups that are driving this trend.

1. The changing nature of work

With hybrid work models becoming the norm, more people are opting into the gig economy, even at the executive level. People who have been finance chiefs for most of their careers are less interested in working 70-80 hours a week, preferring a fractional role where they can work with multiple clients, usually for one or two days a week.

Claire Martell, co-founder and chief executive of Murdock Martell Inc., a fractional CFO firm based in the US, says that some of her best hires have been people like this. “It’s just less persistent and more manageable,” she said.

2. The need for proper financial modelling

Financial models give founders an overview of a company’s operations, expenses and earnings. They enable executives to make key business decisions such as estimating the cost and profits of a new project or anticipating the impact of internal changes such as a change of strategy or business model. They can also be used to estimate the valuation of a business.

With the huge spike in early-stage, VC-backed startups, it’s becoming more important for founders to get a grasp on their financial modelling early so they can plan for the future.

3. Preparing for sustained growth

A fractional CFO can help founders take a step back to rethink their go-to-market strategies. With the rapid pace of change in technology and digitisation, this is more important than ever before. As Dave Rosenberg, Head of Marketing, EMEA at Oracle NetSuite, writes:

“For instance, a startup may benefit from a fractional CFO’s view into revamping its pricing or packaging, identifying discounts with suppliers, or rethinking sales compensation plans to align with new strategies. A fractional CFO can help understand total addressable market and prepare forecasts for how customer segments could be scaled.”

With Environmental, Social and Governance (ESG) standards also becoming increasingly important for both investors and consumers, a fractional CFO can help you prepare and make sure you are compliant with any new regulations.

4. Building credibility for investors

If a startup has plans to aggressively expand and grow, then it must have sound financial leadership and a clear financial strategy that aligns with its growth ambitions. That means a lot more than just being a bookkeeper. They want to see things like how deferred revenue is managed, whether equity is properly accounted for, and see solid information about margins and department costs.

Gian Seehra, an investor and fundraising coach who has helped founders raise $300m+ in venture capital, knows this better than anyone:

“It was one of the first things we did with every investment. Get the founder a CFO-type person to run the numbers.”

However, credibility isn’t just about financial expertise. Just as important is the ability to properly communicate with investors, as Gian explains:

“A CFO properly understands cash-flow and budgeting and is able to give proper communication to investors on how the company is actually doing. The second point is incredibly important from the next fundraising POV, as a lot of founders mess it up, then find out they are cash-out in 3 months!”

5. Market turbulence creates uncertainty

High inflation, a weak pound, volatile global events such as the war in Ukraine, and a looming recession. All conditions to spook investors and reign in capital investment.

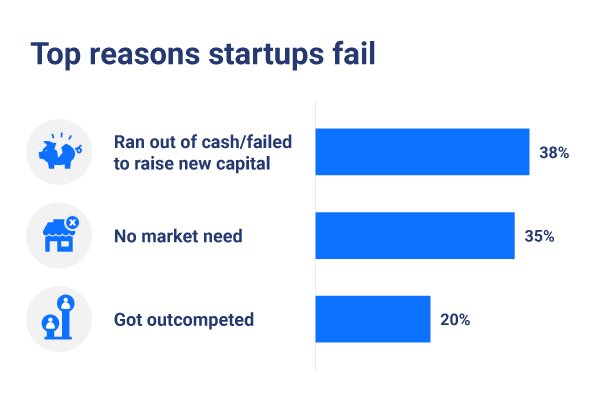

Later-stage startups may need to delay funding rounds or push out IPO plans, meaning cash runway management will be key. According to CB Insights, failing to raise new capital or running out of cash is the top reason startups fail.

This chart from CB Insights shows that running out of cash is the top reason startups fail

With all this uncertainty and a lack of market confidence, an experienced CFO can manage cash runway, build investor confidence, and plan for the long-term while factoring in the key economic challenges countries are facing right now.

Who benefits from hiring a fractional CFO?

Maybe the questions should be…who doesn’t benefit?

Hiring an experienced finance leader, even on a fractional basis, can have a positive ripple effect throughout a startup, from the CEO right through to the newest team member. Let’s take a quick look at the benefits of hiring a fractional CFO:

- For CEOs – building financial models, budgeting, seeing whether you can afford to bring someone in, improving profit margins…none of these fall within the remit of the CEO. By bringing a finance leader who is fully trained, qualified and experienced, results are often transformational. As Tom Shelbourne, CEO of West Country Tech Ltd. explains, “To put it bluntly, in the time that our fractional CFO has been with us, he has doubled our turnover.”

- For board members – a young executive team without much experience can make board members nervous, especially given how complex and fast-moving business is today. Hiring a fractional CFO with the right experience can give board members more confidence in the future direction and stability of the company.

- For investors – the same goes for investors, especially with so much market turbulence. Having someone who properly understands cash flow management, financial modelling and budgeting, and who can communicate to investors how the company is actually doing is incredibly important, especially when it comes to things like fundraising rounds or exit planning.

- Wider team – Hiring a fractional CFO with the right knowhow can serve as mentors not only to young CEOs but also to the wider team. Plus a confident, growing company is a great way to boost morale and keep people happy and motivated.

- Prospects and potential clients – it’s not just internal execs and team members who benefit. Hiring a fractional CFO and have them sit with you in meetings with other CEOs or MDs who want to work with your business may increase your close rate by giving them confidence in you.

Hiring a fractional CFO (a 4-step roadmap)

As we’ve established, the CFO has become the linchpin of any company. Larry Chester, President of CFO Simplified, explains their importance in the following way:

“Determining profitability and ROI on everything that happens in a company is the key to strength and sustainability in a business.

Owners and presidents of companies now see that not just as a mantra that justifies the desk of the CFO, but as a means of protecting the financial strength of a business.”

And with the rise of the fractional CFO, it means that any company, regardless of size or industry, can now benefit from the financial advice and experience of a CFO.

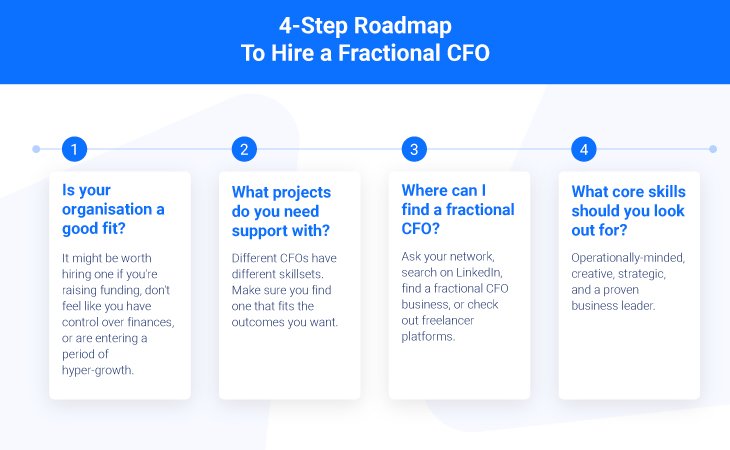

In this section, we’re going to lay out a roadmap for identifying if your organisation is a good fit for a fractional CFO and which projects or milestones (e.g. fundraising round or exit planning) you need them for. We’ll also look at where you can find them and what skills you should be looking for.

The following steps are designed to help you find a right-fit finance chief who can give you the confidence and clarity to make key decisions based on financial outcomes.

1. Understand if your organisation is a good fit

When might an organisation look at hiring a fractional CFO?

“Perhaps as a result of the war on talent, we are experiencing more and more demand for fractional and interim CFOs with specific expertise in investor relations to support fundraising activities pre-series A, which in turn can create a wider pool of permanent talent who are keen to step up into their first role as CFO and professionalise the function,” says Jennifer Brook Botfield.

This is one example. But there are many other reasons, and many stages of a company’s growth, where a CFO or FD can come on board and provide immense value.

It might also be worth hiring one if:

- Your business is growing quickly, but finance is your weak point. You need someone to guide you in making key business decisions such as knowing when and how to grow.

- You don’t have anyone trained in business management on your senior team.

- You don’t feel in control of your company’s data, finances, and analytics, lack a clear understanding of what it all means, and are making key strategic business decisions blind.

- You’re a medium-sized company that is struggling to keep up with the pace of change in technology. You need someone who can help advise and make the right decisions for the long-term interests of the company.

- Your board members and/or investors are not happy with the direction the business is going, and you need an advisor who can provide experience to your executive team and confidence to board members and investors.

- You’re looking to enter new markets abroad but don’t have someone with the operational knowledge and financial know-how to execute.

- Your business is growing, but slowly. You want to speed up your company’s growth rate so you can achieve your goals faster.

- You’re planning to exit and want to get your company’s finances and structure in order while doing everything you can to maximise the business’s value.

- You want to increase profit margins and overall profitability but don’t really understand the best way to achieve it.

It’s worth noting that different CFOs will be required for different transformational stages of the company’s growth. The needs of a pre-seed startup are different from that of a company preparing to go public with an IPO.

“In my experience, it would be very rare to see a CFO skilled at taking an early-stage business on a true scaling journey remain as the same CFO preparing the business for IPO,” says Jennifer.

2. Identify the financial projects you need strategic support with

The next step is identifying where exactly you need support and what outcomes you want to achieve. As Larry Chester says:

“I have seen businesses that were doing less than $2 million a year that had multiple divisions, profit centres, locations that created complexity for the operation of the business. A business like that has a significant number of moving parts, and really needs guidance as to what they should concentrate on.

Where is their greatest profitability? How can they conserve the use of cash? What are the strategic expenditures that will help drive the business forward? What is the trend, in sales, profitability and expenses, for their products or services, and how does that inform how the business should move forward in each area of the business?”

As you can see, there are many complex financial areas that could benefit from the strategic input of a finance leader. Below are some other key areas that a CFO can lead:

- Improving Financial Planning and Analysis (FP&A)

- Leading on investment rounds

- Planning and executing ERP implementation

- Cash runway management

- Preparing for audits for and ensuring tax compliance

- Preparing for regulatory changes and meeting disclosure requirements

- Internal restructures and/or transformational change

- Increasing margins and profitability

- Increasing company valuation

- Filling a leadership/permanent CFO vacuum

- As a Non-Executive Director (NED), giving support and independent guidance in board meetings to directors

3. Where do I start when hiring a fractional CFO?

Now you’re ready to start hiring a fractional CFO, where do you find one? There are lots of options:

- Reach out to your network

- Fractional CFO business

- Freelancer platforms

Reach out to your network

Speak to colleagues, clients, and other small business owners. Chances are someone you know has worked with one, or knows of one in their network. And because fractional CFOs split their time between multiple companies, you won’t need to worry about diverting resources from companies they are currently working with. Even if a CFO in your network isn’t available, they will likely be able to recommend one.

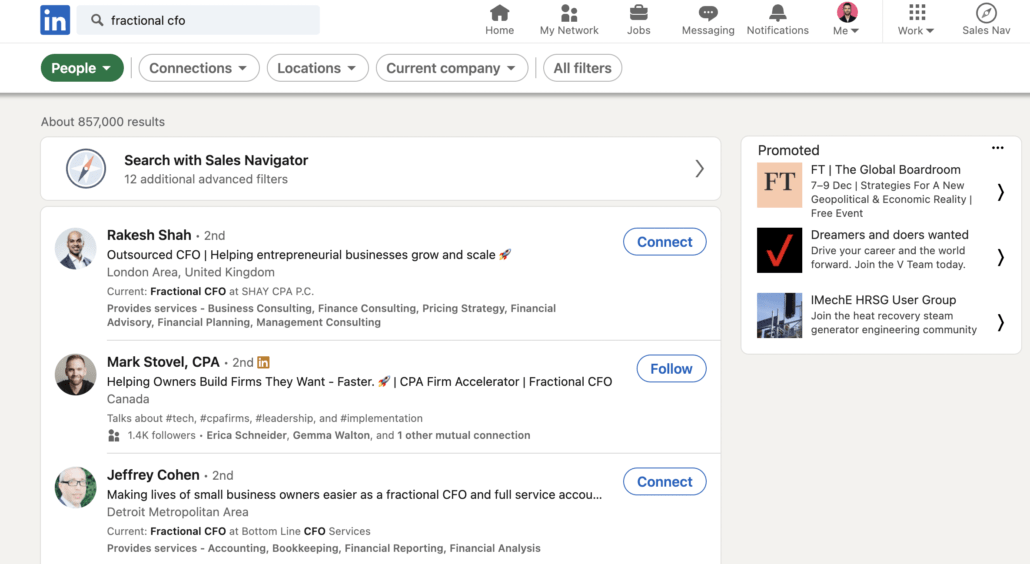

In LinkedIn’s own words, this is the largest professional network on the planet. With 850 million users worldwide, you can reach beyond your personal network to those you’ve connected with on LinkedIn. Better yet, simply type “fractional CFO” or “portfolio CFO” into LinkedIn’s search bar, and click “People”. You can then connect and send a direct message to any profile you think would be a good fit.

Search “fractional CFO” on LinkedIn and click “People” to find a fractional CFO

Fractional CFO business

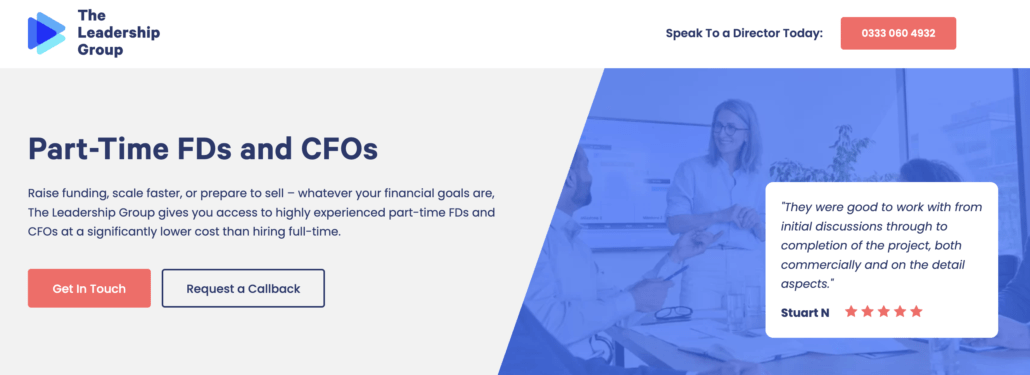

Another option would be to hire a fractional CFO through a business that specialises in providing them. Companies like Leadership Services pre-vet finance leaders to ensure they have the right qualifications, experience, and track record of driving and delivering growth for companies. Once vetted and accepted, fractional CFO companies will provide the part-time CFO with regular work.

Leadership Services provides transformational leadership to startups and SMEs

Freelancer platforms

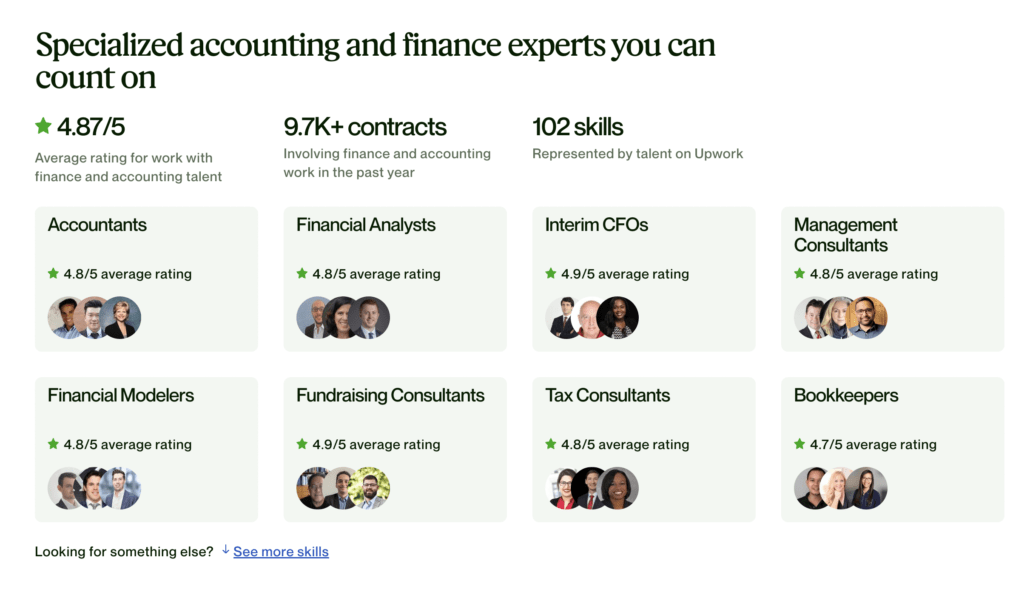

If none of the above options hit the mark, you can always try searching on a freelancer platform such as Toptal or Upwork. On these platforms, you’ll find qualified finance professionals who specialise in accounting, financial analysis, financial modelling, fundraising consultants, tax consultants, and fractional or interim CFOs.

You’ll find all types of financial experts on Upwork, from accountants and consultants to CFOs.

4. Core finance skills to look out for (and that CEOs value most!)

Now let’s look at some key skills and competencies a modern finance chief must possess. The day-to-day financial focus is still necessary, of course. But the demands of providing long-term strategic vision and business leadership are growing.

Understand the numbers

This goes without saying. But it goes deeper than this. CEOs want to be able to look at the numbers and get actionable insights and strategic direction from them. This is where a hiring a fractional CFO comes into play. Their role is to translate those numbers and tell a story about how the business is running.

As Larry Chester explains:

“The entrepreneur’s gut may be telling him/her to go in a particular direction, but the numbers will dictate if that’s the right decision or not. The numbers don’t lie.”

Operationally-oriented

As Rob Nicholls, says, “The COO is largely falling away today with the CFO taking on those responsibilities.” The expanded mandate, as referenced above, means taking on more cross-functional and commercial responsibilities.

CFOs need to have a strong understanding of the company’s business model, of the industry, and must be able to constructively challenge commercial and ops teams, navigate data and analytics, and identify opportunities for top-line growth. It’s changing business operations that improve the bottom line, not moving numbers around the balance sheet or income statement.

Creative

Creativity might not be a skill that you would typically apply to a numbers person. And maybe twenty years ago that could have been the case. But today, with an expanded mandate and expectation to improve revenue by delivering change, a good CFO must be creative.

“A good CFO can use their experience to come with creative solutions to nearly any problem or issue the business is facing,” says Larry.

Leadership

Finance chiefs are expected to be business leaders in companies today, effectively right hand to the CEO. That means on top of providing cash flow planning and financial reporting, they must be able to communicate effectively (to the board, investors, management and the wider team), act as an advisor and mentor, work with HR to oversee the talent pipeline and lead group-wide transformation programs.

Strategic

As the CEOs’ right hand, it’s also essential they can see the big picture, advise on strategy development, and help with its execution. “They can often be very head down fighting fires or just what’s in front of them. We allow them to look up and plan effectively,” says Jim. This is just as important for successful businesses as well as those struggling to survive, but especially so for fast-growing startups.

For Larry, it’s about “helping businesses that are experiencing explosive growth understand how that level of growth strains a business’s assets, and provide them with strategic planning tools, KPIs, budgeting and financial modelling so that they can see what the possibilities are for the company in different scenarios.”

Fractional CFO onboarding challenges to prepare for

Raising VC funding, preparing for external auditors, or managing cash runways. All of these are complex challenges that require leadership, operational know-how and financial expertise to achieve. Below are some of the key challenges you should be prepared for:

1. Gathering information

To get a true understanding of the base position of the company – which is critical to provide accurate projections and strategic guidance – CFOs need full visibility of business operations. This isn’t always easy, as Jim acknowledges:

“A lot of companies that engage fractional CFOs aren’t in the best management reporting position as they may use cheap external bookkeepers who don’t really know their business operationally, they just process invoices and their VAT each quarter.

As a consequence, their numbers are out of date by two or three months, their reporting is inaccurate, and they don’t capture the relevant information they really need.”

This can be problematic. If the proper reporting mechanics aren’t in place, then one of the first major tasks of any incoming fractional CFO will be to put them in place. Because metrics matter. They give CFOs crucial visibility into the health of an organisation and what direction they need to take and can be the difference between hiring a new team or making redundancies.

Jim continues:

“I’ve seen too many horror stories where some outsourced accountants suddenly drop out of the blue that the business is close to running out of cash and there’s been no real visibility of how things are.

This is no way to run a business. It needs someone to help the founder or management team to put the basic reporting and controls in place to ensure they always have the best visibility they can.”

2. Creating alignment

The internal politics of onboarding a new CFO can also create tensions if not managed correctly. Let’s look at an example to illustrate this point.

Let’s say an organisation is preparing to go public. The finance team has a lot of respect, and a great relationship, with the CFO who has taken them on a journey to this point. But the leadership team acknowledges that a CFO with a different skillset is needed to take them on the next phase of their journey to IPO and beyond. So they start looking for an interim or fractional CFO.

Jennifer Brook Botfield points out that:

“More often than not, strategic and/or operational gaps will come to exist across the finance function. None of which paint a wholly negative picture but inevitably require immediate change. This is namely to remain fit for purpose as they continue their growth journey.

And typically, where there are varying levels of political management skills required is the need for high-impact relationship building. Constructing those alliances quickly – within both the finance team and wider business – can prove a challenge for some CFOs. But this is where you see the best excel.”

This isn’t to say that people within businesses have something against interims or fractional CFOs. It’s simply that there is pressure to embed quickly into the business to demonstrate value as soon as possible. If they can’t do this, building trust will be a challenge – which will ultimately be a detriment to their success.

So coming on board, building positive relationships and alignment quickly, and demonstrating value early, will all help create department and company alignment that will promote positive change, growth, and continued transformation.

3. Long-term vs. short-term performance

Yes, delivering value quickly in the short-term is critical, as mentioned above. This gets stakeholder and team buy-in and helps to build trust in the CFO’s vision and strategic direction. But just as important these days is for CFOs to be “stewards of the long-term”:

“What it means is the finance functions have to focus and put in place KPIs [key performance indicators] and metrics that talk about the long-term value creation.

It is one of the imperatives for the CFO of the future: to be the value architect for the long term. It’s one of the very important aspects of how CFOs will be measured in the future,” says McKinsey partner, Ankur Agrawal.

This is difficult to do, especially when everyone from the board and investors to the leadership team and founders all look for short-term performance.

It just means that CFOs have the added responsibility to properly define and communicate the long-term narrative, of how value is being created over time, and providing proof points along the way.

Conclusion

Never has the mandate of the CFO been so broad and their role so important to companies experiencing growth, change or transformation. As technology continues to advance, and with global economic uncertainty expected to last, it has become more critical than ever for CEOs and founders to make sure they have an experienced finance leader on their books who can guide them.

Hiring a fractional CFO allows organisations to do just that. Startups, high-growth companies, or SMEs undergoing a period of significant change can hire a chief finance officer on a part-time basis to help with specific projects such as leading on investment rounds, improving FP&A, planning and executing ERP implementation, or preparing for audits and regulatory changes.

Understanding the numbers and being able to translate those numbers to tell a story about how the business is running remains the core competency. But beyond that, CFOs now require more skills such as being highly creative, operationally oriented, and strategic. And above all else, they must be able to provide business leadership as the right hand to the CEO.

Leadership Services has a simple mission: to give CEOs access to the experience, skillset and expertise of exceptional Finance, Marketing and IT leaders who can drive business growth through transformative leadership.

We are a group of seasoned C-Suite Executives and Directors who work exclusively on a part-time or fractional basis, meaning that companies that do not need a full-time counterpart can leverage the knowledge and experience of a proven visionary leader with a track record of guiding organisations through growth and transformation.

Unlike consultants, our fractional leaders join and lead your team from within, actively taking ownership of all strategic decisions and project delivery.

If you’d like to learn more about how Leadership Services empowers businesses with transformative financial leadership, from critical early-growth stages right through to exit planning, please get in touch.