Most SME leaders think they understand marketing ROI. They divide revenue by marketing spend, multiply by 100, and call it a day. But here’s the uncomfortable truth: this approach is costing British businesses millions in wasted spend and missed opportunities.

After working with hundreds of SMEs, we’ve discovered that the real marketing ROI secrets aren’t about fancy formulas: they’re about understanding the hidden complexities that most businesses completely overlook.

Why Most SMEs Get Marketing ROI Wrong (And It’s Not Their Fault)

The marketing industry loves to keep things simple on the surface. “Spend £1, make £3 back, celebrate success.” But any experienced fractional marketing director will tell you that’s nonsense.

Here’s what actually happens: You spend £10,000 on a digital campaign. It generates £30,000 in attributed revenue. Your ROI calculator shows 200%: fantastic! Except you forgot to account for:

- Cost of goods sold (£18,000)

- Staff time managing the campaign (£2,000)

- Payment processing fees (£900)

- Returns and refunds (£1,500)

Your actual profit? Just £7,600. Your real ROI? A modest 76%.

Most SMEs never do this deeper calculation because nobody teaches them to. Marketing agencies certainly don’t volunteer this complexity: it makes their results look less impressive.

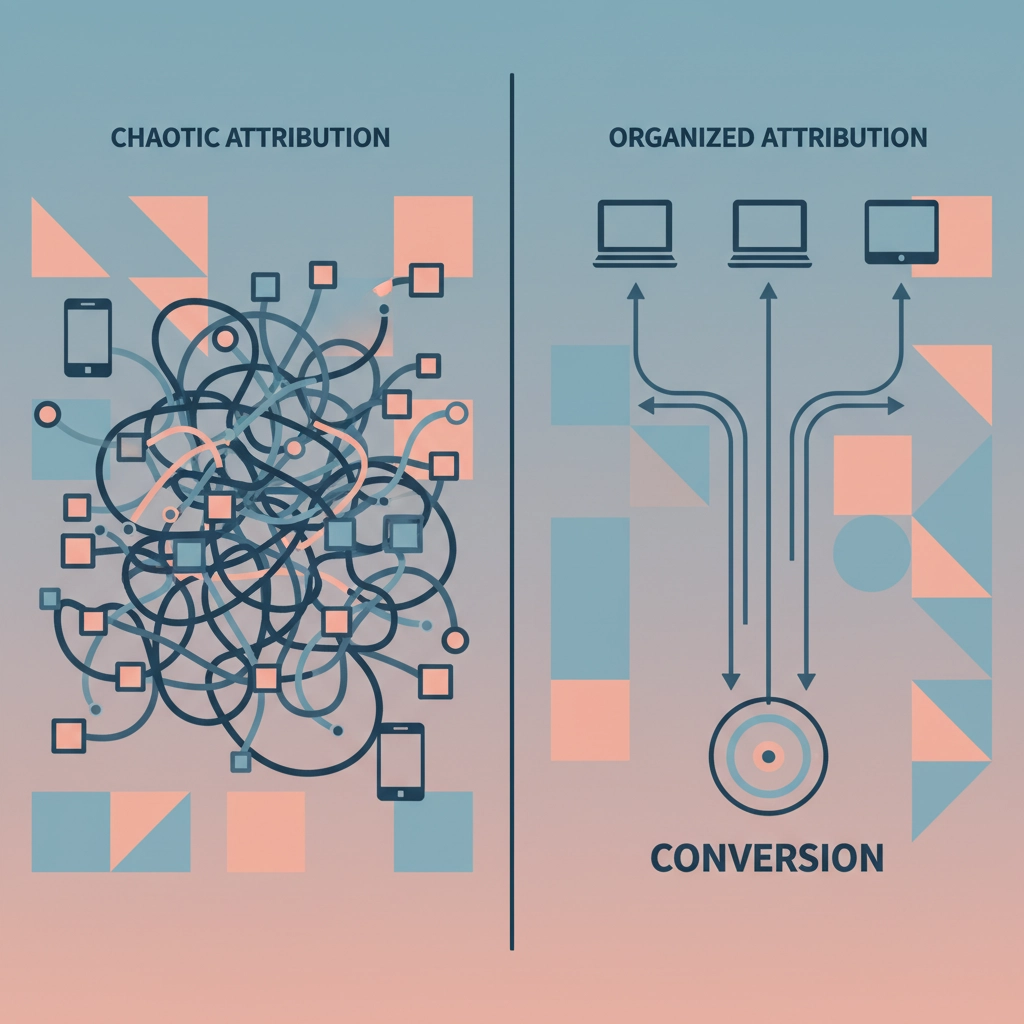

The Attribution Nightmare That’s Costing You Money

Here’s a secret the digital marketing world doesn’t want you to know: only 29% of marketing professionals have genuine confidence in their attribution systems. Yet 75% claim they’re using sophisticated multi-touch attribution models.

Translation? Most businesses are flying blind, crediting the wrong channels for their success.

A fractional marketing director recently shared this example: An SME was spending £15,000 monthly on Google Ads, celebrating their “successful” campaigns based on last-click attribution. When they implemented proper multi-touch tracking, they discovered that 60% of their Google Ads conversions actually started with organic social media engagement.

They were overspending on paid search by £9,000 monthly while underfunding their most effective channel.

The Organic Growth Trap

Most SMEs make this critical error: they credit marketing for all revenue increases. But businesses naturally grow over time through referrals, repeat customers, and market expansion.

The correct formula subtracts your organic growth rate from total growth before calculating marketing ROI. If your business typically grows 15% annually without marketing efforts, don’t credit your campaigns for that baseline increase.

What Fractional Marketing Directors Do Differently

Experienced fractional marketing directors bring three crucial capabilities that transform ROI measurement:

1. They Implement True Cost Accounting

Instead of just tracking obvious expenses, they account for:

- Administrative overhead (usually 10-15% of campaign spend)

- Opportunity costs of internal resources

- Customer acquisition costs across the full journey

- Lifetime value calculations that reveal long-term impact

2. They Set Up Proper Attribution Systems

This isn’t about fancy software: it’s about understanding customer journeys. They implement:

- UTM parameter standards across all channels

- Conversion tracking that captures micro and macro conversions

- Cross-device tracking for accurate customer journey mapping

- Baseline measurement to isolate marketing impact from organic growth

3. They Focus on Predictive ROI

Rather than just measuring past performance, they use historical data to predict future ROI across different scenarios. This enables better budget allocation and prevents the common mistake of chasing vanity metrics.

The Quick Wins That Only Seasoned Experts Know

Here are the immediate ROI improvements that fractional marketing directors typically deliver:

Fix the 80/20 of Attribution Issues

- Implement proper Google Analytics 4 conversion tracking (most SMEs have this wrong)

- Set up phone call tracking for offline conversions

- Create consistent UTM naming conventions

- Install Facebook Pixel and Google Tag Manager properly

Identify Hidden Revenue Leaks

- Audit existing customer data for upselling opportunities

- Implement email sequence for abandoned prospects

- Review and optimise conversion funnels for obvious drop-off points

- Analyse customer lifetime value by acquisition channel

Stop Wasting Budget on Vanity Metrics

- Shift focus from impressions and clicks to actual revenue

- Eliminate campaigns that generate leads but not customers

- Reallocate budget from brand awareness to performance channels

- Implement proper testing frameworks for creative and messaging

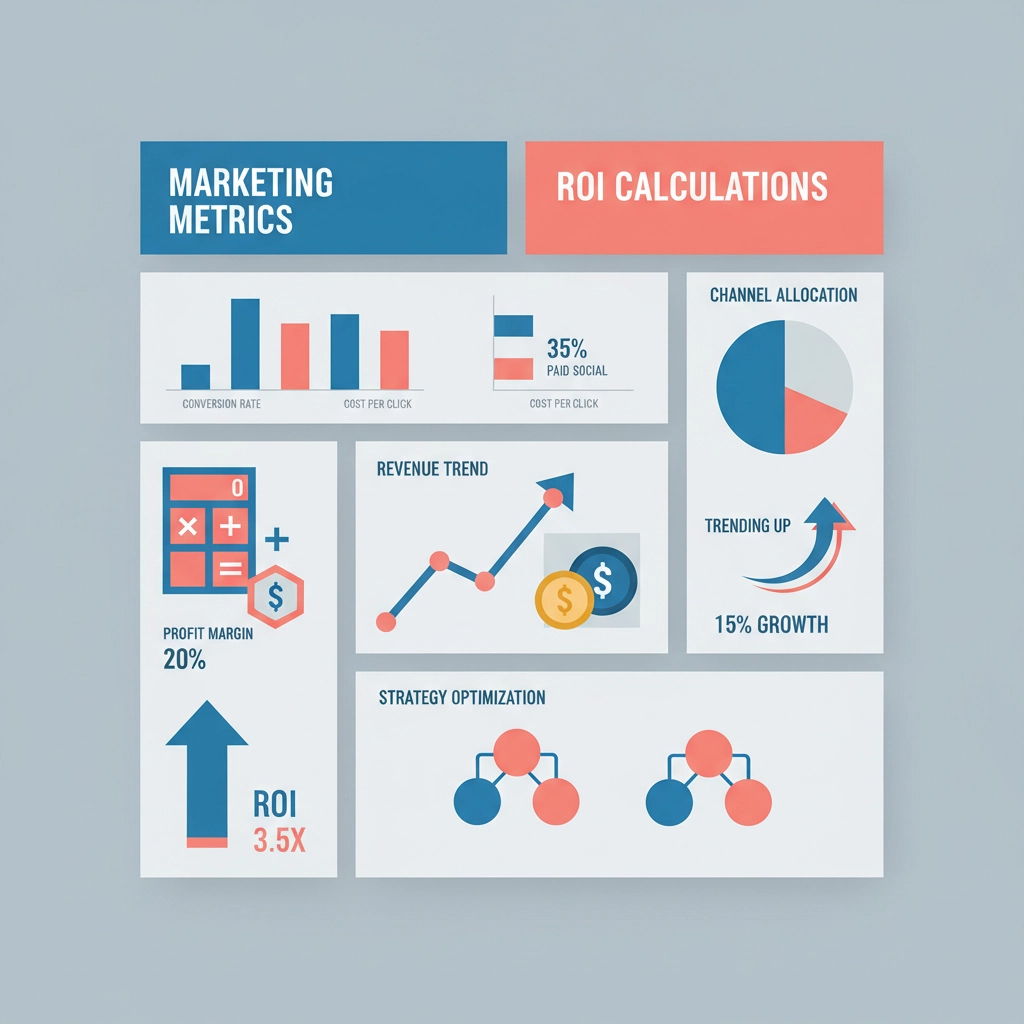

The Three ROI Calculation Methods You Actually Need

Forget complex formulas. Here are the three calculations that matter:

1. Simple Campaign ROI

(Revenue – Campaign Cost) ÷ Campaign Cost × 100

Use this for quick campaign comparisons and initial assessments.

2. True Profit ROI

(Gross Profit – Total Marketing Cost) ÷ Total Marketing Cost × 100

This accounts for cost of goods sold and provides realistic profitability data.

3. Customer Lifetime Value ROI

(CLV – Customer Acquisition Cost) ÷ Customer Acquisition Cost × 100

Essential for subscription businesses and high-retention sectors.

When It’s Time to Bring in Expert Help

Most SME leaders try to handle marketing measurement themselves, but certain signals indicate you need professional expertise:

- You’re spending over £5,000 monthly on marketing but can’t confidently explain which channels work best

- Your marketing team talks about impressions and engagement but can’t connect activities to revenue

- You’ve hired agencies that can’t provide clear ROI reporting

- Your conversion tracking setup is over 18 months old (tracking methods evolve rapidly)

- You’re making major budget decisions based on intuition rather than data

A fractional marketing director brings enterprise-level measurement expertise without the full-time executive cost. They implement systems, train your team, and establish processes that continue delivering value long after their initial engagement.

Frequently Asked Questions

What’s a good marketing ROI for SMEs?

Most successful SMEs target 300-500% ROI, but this varies dramatically by industry and customer lifetime value. B2B service businesses often accept 200-300% due to higher customer values, while e-commerce businesses might need 400-600% to remain profitable.

How quickly can I expect to see improved ROI from better measurement?

Proper tracking systems typically show immediate impact: you’ll spot obvious waste within the first month. However, building reliable attribution data requires 90 days of clean tracking for meaningful insights.

Should I hire a fractional marketing director or full-time marketing manager?

If your marketing spend exceeds £10,000 monthly and you lack senior marketing expertise internally, a fractional marketing director provides better ROI. They bring strategic experience and implement systems that your team can then execute.

What’s the biggest mistake SMEs make with marketing ROI?

Focusing on channel-specific metrics instead of overall business impact. The channel that generates the most clicks might not generate the most profit, and the “expensive” channel might deliver the highest lifetime value customers.

The uncomfortable truth about marketing ROI is that most businesses are measuring it wrong, making decisions on incomplete data, and missing opportunities for dramatic improvement. The good news? These problems are entirely fixable with the right expertise and approach.

If you’re ready to discover what your marketing is actually returning and unlock the hidden ROI potential in your business, it’s time to consider bringing in someone who’s solved these challenges before. The investment in proper measurement expertise typically pays for itself within the first quarter; and the competitive advantage lasts much longer.